Our 2021 Midyear Market Update

By Jeff Gilbert

If 2020 taught us anything, it’s that we can’t predict the future, nor do we have control over many of the things we once took for granted—things like how we work, how we go to school, and even how we interact with our loved ones. With those lessons fresh in our minds, most of us entered 2021 with a bit of apprehension.

Although we didn’t know what to expect, we’re now halfway through the year (believe it or not) and on our way to putting the COVID-19 pandemic behind us. July is the perfect time to take stock of what’s happened so far in 2021 as we continue recovering—emotionally and economically—from the pandemic.

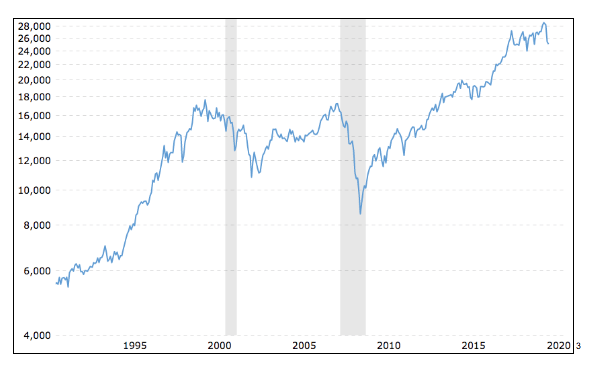

Stock Market Performance

As vaccine rollouts have allowed many businesses to return to normal, some experts believe we may be entering a booming economy. (1) Stock market performance has been mildly volatile in the first half of this year with an overall trend toward growth. The S&P 500 reached its highest level this year on May 7, with a year-to-date return of 14% as of June 4. (2) The Dow Jones has also shown overall growth this year and is up 15% as of June 4. (3)

Meanwhile, the NASDAQ has shown greater volatility with a yearly low of -2.17% in early March, up to 9.7% at the end of April, and ending at 8.79% as of June 4. (4) Many experts have warned that while they are optimistic about market performance in 2021, that performance will likely be riddled with volatility throughout 2021 and in the coming years. (5)

A Shaky Return To Normal Employment Levels

It has been generally expected that as businesses reopen to full capacity, the number of unemployment claims and levels of unemployment will return to normal. As many of us have seen in the news, however, this is currently not the case. (6) Along with other businesses in the hospitality industry, restaurants are especially struggling to replace their workers and remain understaffed in the face of increasing demand from consumers.

Some commentators believe workers are reluctant to return to work because of continued unemployment assistance from federal and state governments. Others argue that many workers are unable to return to work yet because they are still wary of the coronavirus, are unable to find affordable childcare, or now have the time to look for more stable, higher-paying work outside of the hospitality industry.

Whatever the reason for the worker shortage, worker benefits and wages may undergo drastic changes in 2021 and beyond as the economy returns to normal. In any case, getting workers back into the workforce remains a key component of the U.S. recovery plan.

Interest Rates & The Federal Reserve

Interest rates continue to remain low, as the Federal Reserve has promised. In an effort to encourage consumers to keep borrowing, the Fed has kept interest rates near zero since the onset of the pandemic. They have stated they will likely not raise rates again until 2023, when it is more likely that inflation rates will reach desired targets. (7)

For now, the near-zero interest rates may be attracting first-time homebuyers who have been able to weather the economic pressures from the pandemic. However, home prices have surged 13.2% over the past year, (8) igniting some fears that a housing bubble may be looming.

How Should You Respond?

We’ve always said that market performance is impossible to predict with accuracy. As 2020 and 2021 have taught us, market performance may be impossible to predict at all. The truth is, we never know what lies ahead, but that shouldn’t prevent us from taking the steps to protect ourselves and pursue financial freedom.

Now more than ever, it’s important to know you’re making the financial decisions that are moving you toward your goals. At Balboa Wealth Partners, we specialize in helping our clients reach financial independence using sound financial strategies that align your day-to-day decisions with your long-term financial plan. If you’d like to see how we can help you, I invite you to give me a call at 949-445-1465 or email me at jgilbert@balboawealth.com.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With over three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout the entire country. To learn more, connect with Jeff on LinkedIn or email jgilbert@balboawealth.com.

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

_____________

(3) https://www.google.com/finance/quote/.DJI:INDEXDJX?window=YTD

(4) https://www.google.com/finance/quote/.IXIC:INDEXNASDAQ?window=YTD

(5) https://www.morganstanley.com/ideas/stock-market-outlook-2021